We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

Blog

5 Ways to Organize Tax Documents with Sheet Protectors

When it comes to storing current and past tax documents, there are a variety of directions to go. Expanding files, project folders and document cases are all great options to pick from.

However, if you want to ensure that documents remain visible and easily accessible, using sheet protectors is a better approach. Regardless of the style chosen, the sheet protector will preserve documents, while also making it possible to look-up information quickly.

C-Line has over 40 sheet protectors to choose from ranging in style, size and design.

Here are the top 5 ways sheet protectors should be used to organize your tax time documents.

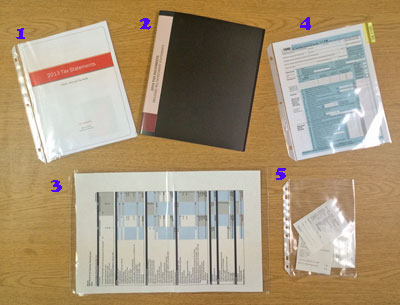

There are five different styles of sheet protectors that will work great for storing different size tax documents. There are five different styles of sheet protectors that will work great for storing different size tax documents. |

- Store previous tax returns as a whole in the High Capacity Sheet Protectors, which can store up to 50 sheets at one time.

- Organize documents by assigning each year to a 24-Pocket Bound-In Sheet Protector Book and storing all paperwork into one book.

- Investment documents often come on letter or ledger size paper so using the Panoramic Sheet Protectors would make the entire page visible when the holder is folded out.

- Use the Sheet Protectors with Tabs to divide the documents inside a binder, making it easier to locate information without taking up storage space.

- Need smaller storage for receipts? The Mini Size Sheet Protectors are secure storage for small items, while still being able to keep the receipts with all of the tax time documents.

Leave a Reply

Your email address will not be published. Required fields are marked *